Subscribe to The Financial Brand via email for FREE!

What is on people’s minds these days as they contemplate spending, saving and borrowing as the “new normal” economy begins to reveal itself?

The closest thing to a crystal ball, short of expensive consumer studies, is a free service called Google Trends. The search giant gives everyone a way to examine trends in search on any subject. In fact, you can even compare multiple words or terms to see which appears to be hotter. The Google database for this service runs from 2004 to the present.

Every year or so The Financial Brand digs into Google Trends to see what’s on the minds of consumers, financial executives and others who touch the banking business. This year’s selection, influenced in part by the unprecedented conditions seen during the pandemic, constitutes the most comprehensive review since the first one came out in 2012.

In the Google Trends charts that follow, please note that the time period displayed in each chart — the horizontal axis — varies depending on the trends noted. The vertical axis represents the relative increase (or decrease) in the volume of searches Google’s users performed. The top level seen in a given search becomes the “high water” mark and everything else in that search is indexed to that value. (Google does not give out actual search numbers in this free service. The analyses are based on a sampling Google takes from the billions of searches made. The company explains that Google Trends is not the equivalent of polling data and “merely reflects search interest in particular topics.”)

Our review covers six major areas, each with several subsections. Trend comparisons were performed for U.S. users’ searches only.

1. Digital Banking, Big Techs, Fintechs and Industry Transformation

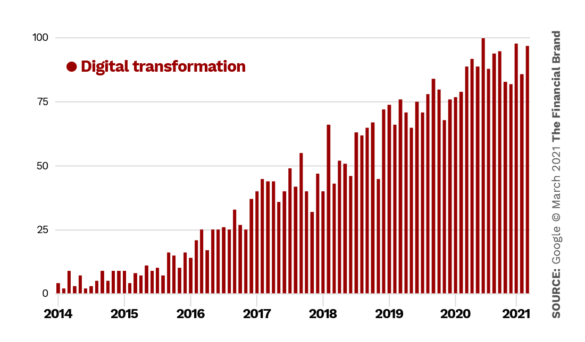

Digital Transformation Dominates Discussion

While “Digital Transformation” has been a big story in banking for several years, the pandemic accelerated this massive shift, now encompassing ecommerce as well as digital transactions, not only in banking, but in nearly every industry from medicine to entertainment. So it is not surprising that the general level of interest in digital transformation has reached top levels in 2020 and 2021.

( Read More: How to Avoid Digital Transformation Failures in Banking )

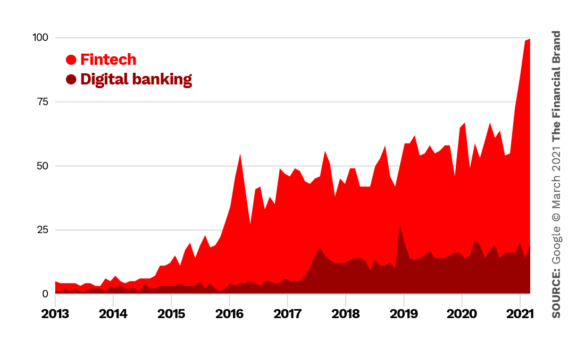

Fintech’s Hot, And Digital Banking’s Cold By Comparison

What’s been amazing to watch is how interest in “fintech” has continued a steady annual climb, overall, to a spike in 2020-2021. Interest in that dwarfs interest in “digital banking.” The fintech industry began quietly at first as traditional financial institutions were distracted by the recovery and cleanup from the financial crisis. Over time many fintechs gave up the “we’re going to bury banks” attitude for today’s more nuanced and varied approach. Some see traditional institutions as partners or even enablers, some still want to replace traditional players and a few, like SoFi, Square and Varo have chosen to pursue bank charters.

The most recent steep spike likely reflects, at least in part, the spate of announcements among neobanks.

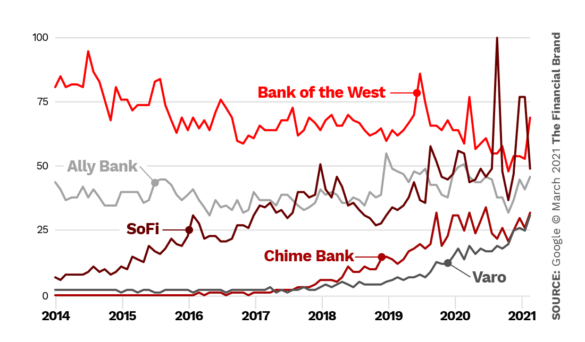

We took a look at the trend in searches for fintechs, using three fintech banks (or neobanks) as examples. For comparison’s sake, we contrasted them with two traditional banks. One is Bank of the West, a midsize player noted for its digital capabilities. The other is Ally Bank, transformed from its captive auto finance roots into a leading digital-only bank.

With the exception of a couple of spikes of interest in SoFi, Bank of the West overshadows the fintechs. (The first spike in the chart appears to correlate with the opening of Los Angeles’ SoFi Stadium in September 2020.)

Increasing interest in SoFi, Chime and Varo clearly represent heavy marketing spending by these firms. SoFi, for example, spent in the range of $200 million annually even before acquiring the naming rights to the stadium.

Read More:

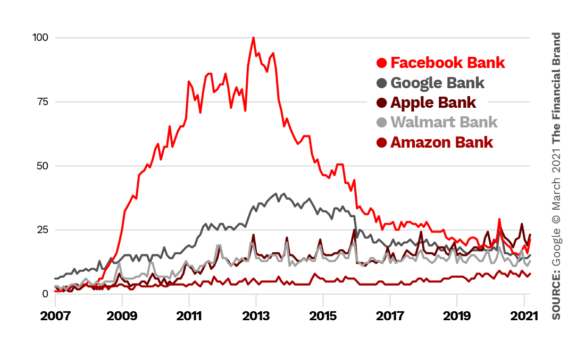

‘GAFA’ And Walmart Should Still Haunt You

While the fintechs mentioned above are real businesses, one of the potential threats that has arisen is the idea that “GAFA” — Google, Apple, Facebook and Amazon — or Walmart would start a bank of their own. While various consumer surveys have indicated that many would consider opening accounts with such newcomers, actual interest appears to have tailed off drastically. Even Facebook’s much-publicized efforts to enter the cryptocurrency space, beginning in mid-2019, haven’t raised interest levels.

But this could be misleading. The overall trend suggests that there is latent interest, smoldering and ready to burst into flame. GAFA has already selected slices of finance, though not labeled as a “bank.” Walmart has partnered with Ribbit Capital to create a fintech. More will be heard later in 2021 about the Google Plex partnerships.

( Read More: Google Claims It Has ‘No Interest In Ever Becoming a Bank’ )

Whose Name Is On Your (Digital) Wallet?

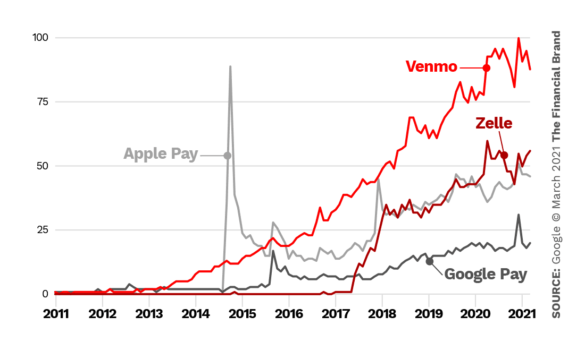

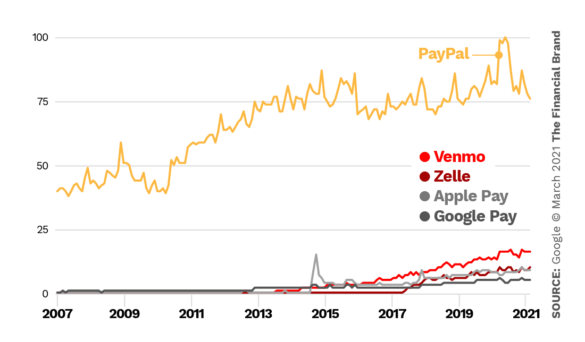

A major aspect of banking is the payments business and increasingly digital options, spurred by both convenience and the coronavirus. In recent years interest in Venmo, followed by Zelle, Apple Pay and Google Pay, has been growing.

In the first chart below, Venmo is clearly the winner for people’s attention. Venmo has been around for P2P payments since 2009, while Zelle, banking’s competitive response, is a shared mechanism unveiled in mid-2017. One more observation: The spike seen for Apple Pay appears to coincide with its introduction in 2014. Search interest in the digital wallet has never risen so far since.

( Read More: Digital Transition Poses Key Payments Choices for Financial Institutions )

However, everything is relative in the world of Google Trends. When you add the element of PayPal, which owns Venmo but which offers more payment channels, including, now, a buy now pay later option and consumer crypto spending, interest flattens that in Venmo, Zelle, Apple Pay and Google Pay.

Read More:

REGISTER FOR THIS FREE WEBINAR

Transform Business Onboarding: Optimize Time to Value and Capitalize on Growth

Cross and up-sell additional services based on business needs. Effectively on-board business customers to maximize time to value, garner repeat business, and drive deeper engagement.

Wednesday, March 31ST 11Am (ET)

2. Looking At Search Patterns Concerning Service Channels

Mobile’s Upward Mobility

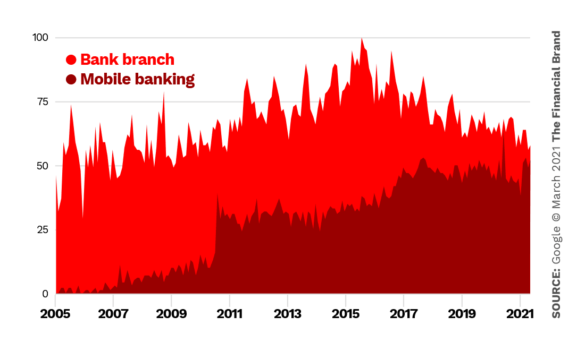

The importance of digital channels during the pandemic, especially during the earliest days, has been widely noted, accounting for the rise in interest seen in mobile banking in 2020, as shown in the chart below. This growth in interest came on top of a growing wave of searching that took off in 2010-2011.

However, branches remained important to many people even at the height of the first year of the pandemic. In summer 2020 Mary Mack, Wells Fargo Senior Executive Vice President/CEO of Consumer & Small Business Banking, told The Financial Brand that over a million people daily were still visiting the company’s branches.

For branches the high point for search interest was mid-2015, with the trend heading generally down after that. While mobile searches haven’t exceeded branch searches yet, at several points the gap has narrowed significantly. In April 2020 the gap was only a dozen points apart, likely reflecting consumers’ sudden interest in remote banking channels.

Clearly mobile is on the rise, branching interest is falling.

Read More:

Interplay Of COVID And Cash Impacts Choices

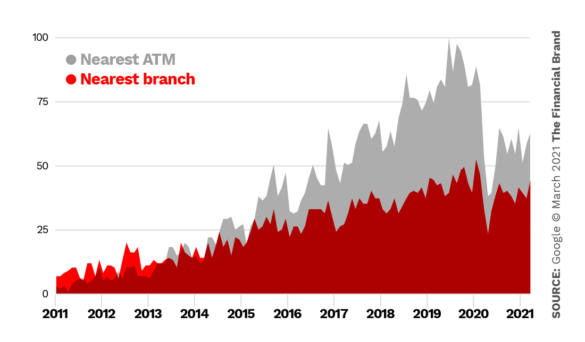

After mid-2015 searches for “nearest ATM” have consistently come in higher than searches for “nearest branch.” In fact, for almost two years searches for ATMs rocketed by comparison to branches. But then came a plunge for both as the country entered the early days of the pandemic, with lockdowns for all but essential workers and essential errands for a time. This period shows how severely consumer mobility and retail activity were reduced — people need ATMs less often when they aren’t spending cash anywhere, and most of the places one would typically need cash were likely COVID danger zones

While search has picked up since the plunge, it’s at much lower levels (ATMs continue to be ahead of branches). How far it comes back remains to be seen.

When ‘When’ Is As Important As ‘Where’

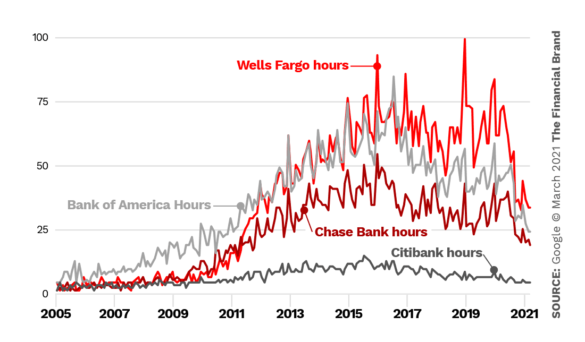

Interestingly, checking for the hours of branches for the four largest U.S. banks followed the overall downward trend for branch searches reflected in the two charts above. Again, the need for cash fell off and how much that comes back, with the trend towards contactless banking and fears of some people of cash, remains to be seen.

The vast difference between Citibank and the other three banks mostly likely arises because Citi has many fewer branches than the other three banks. Wells, BofA and JPMorgan Chase each had upwards of 4,000 domestic branches according to FDIC records in March 2020. Citi had just over 700.

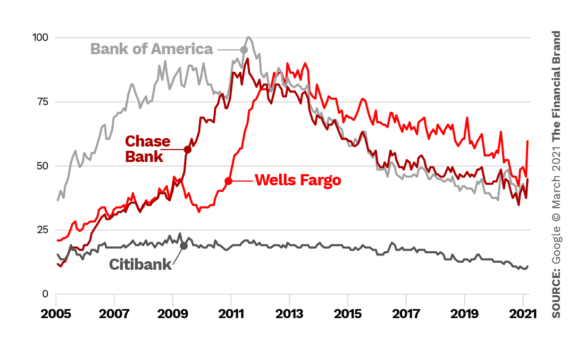

Searches for the top four banks themselves followed roughly the same relative ranking in the most recent periods.

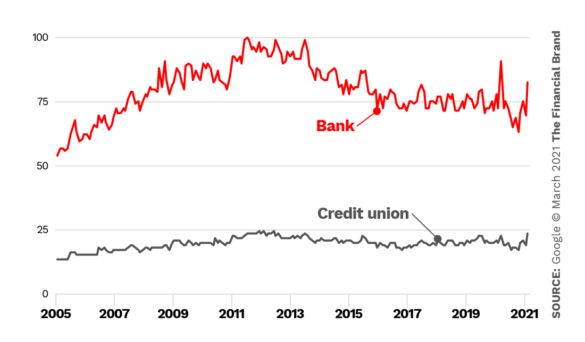

There are many more searches for banks than for credit unions. This may be the product of “bank” being a generic term as well as a specific one, while “credit union” refers to specific type of financial institution. Many credit unions still have some degree of membership definition or definitions, and potential members often know of the opportunity to join. As a result they may not need to search.

Read More:

3. When Your ‘Banker’ Isn’t A Human

Some of the most-written-about names in the industry aren’t people at all. Take “Erica,” Bank of America’s digital assistant or Capital One’s “Eno.” They handle many tasks that used to be the province of branch-based retail bankers and call center staff, and much more.

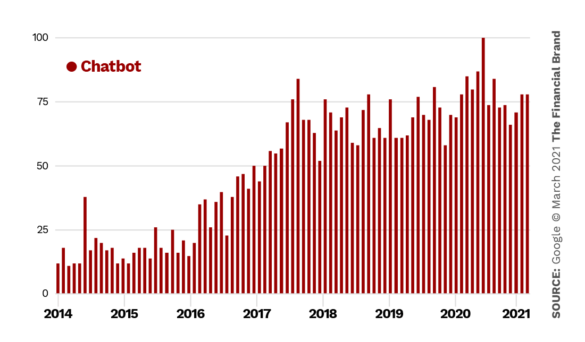

These tools or interfaces, depending on how you think of them, are at the high end, but a growing number of institutions have at the least moved to simpler chatbots, which augment human staff.

Interest in chatbots has picked up in recent years overall, as many people grow more accustomed to being served by technology.

“Accustomed to,” we say, because it’s not everyone who enjoys the experience. And popular media has long enjoyed painting artificial intelligence, the science behind such interfaces, with a sinister brush.

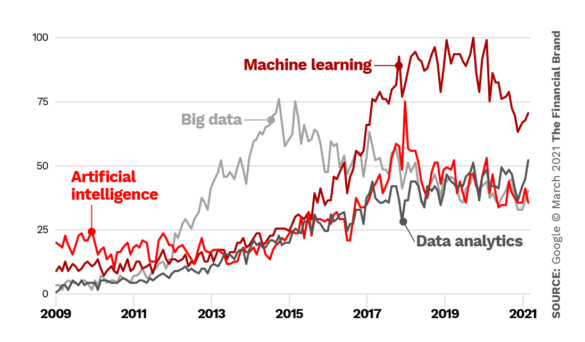

At present, according to the next chart, more people seem to search for “machine learning,” a subset of the broad usage of AI. Over time, as more people begin to understand more about the science, their search interests — and comfort level — may evolve. This likely reflects searches by business people, rather than searches by consumers.

4. The Evolving Face of Financial Marketing

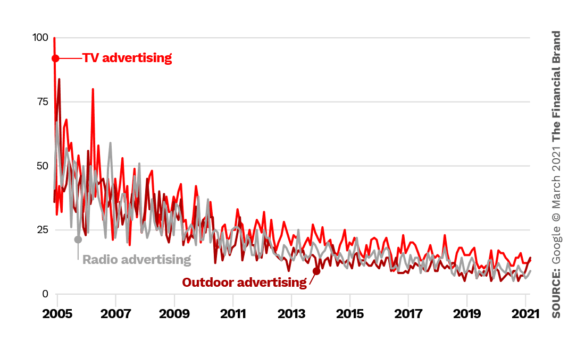

The financial marketer’s choices today have multiplied greatly. While traditional forms of marketing remain — TV, radio, outdoor —they have tailed off both generally and in relation to newer forms of promoting products and services.

Digital’s Squashing Traditional Channels

In the chart below, the drastic erosion in interest in outdoor advertising and radio promotion can be seen, but even as TV advertising continues to elicit stronger interest than the other two channels, it has fallen tremendously in relation to the comparatively recent past.

The fact that people still watch “regular TV” and still listen to radio and still pass certain locations frequently accounts for the fact that banks and credit unions continue to use such channels, perhaps more judiciously. For example, when Varo Bank debuted its branding in early 2021, it actually engaged outdoor artists to hand paint ads in urban neighborhoods to attract its target audience.

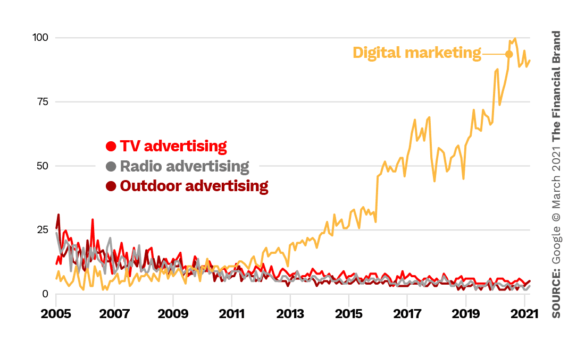

But where have all the dollars gone? Clearly, as the chart of search trends below shows, digital marketing has stomped hard on the older channels. It’s not even a race anymore.

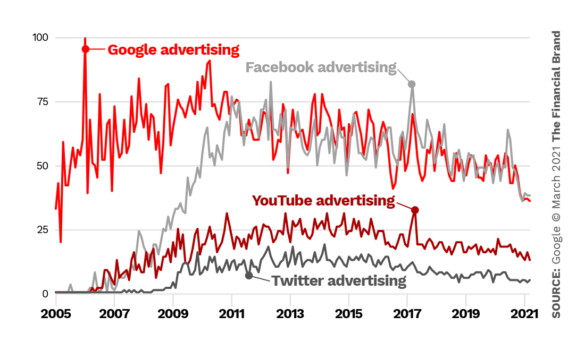

A sampling of the relative interest in key forms of digital marketing, though by no means all of them, can be seen in the chart below. Google began as and continues to be an advertising company and it dominated attention in the earlier 2000s. Google bought YouTube in 2006, about the point that the chart indicates the video channel really began to register on the public. While Twitter has expanded its advertising inventory, Facebook began to compete for dominance with Google about a decade ago and the battle continues.

( Read More: How Google Keeps Changing Financial Marketing )

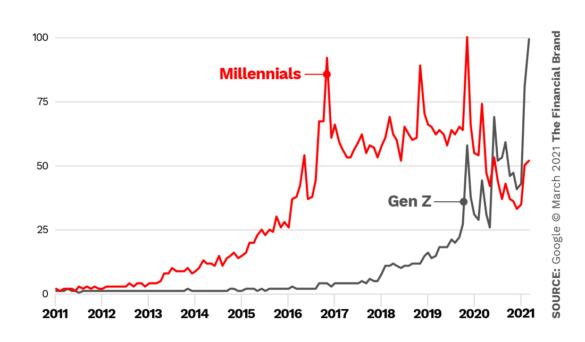

Millennials Bowing As Gen Z Takes the Stage

In 2018, when The Financial Brand last looked at pending issues through Google Trends, interest in Millennials blew away interest in Generation Z. But in the last couple of years, as shown in the graph below, the situation has flip-flopped. The oldest Millennials are hitting their 40s in 2021. Meanwhile, as Gen Zers grow older — the oldest of them are turning 24 — they are increasingly coming onto the banking industry’s radar.

( Read More: Is Everything Bankers Think They Know About Millennials & Gen Z Wrong? )

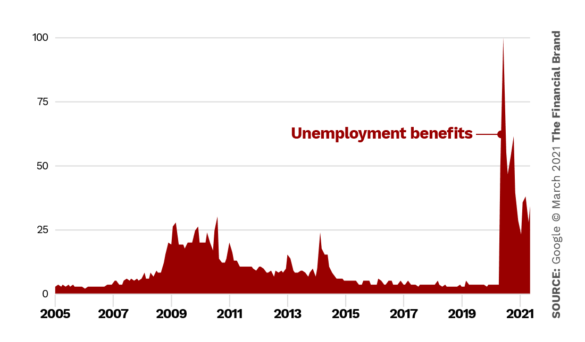

5. The COVID Economy And Consumers’ Mindset

The world desperately wants to be “done with” COVID-19. Yet the inescapable fact is that the events of 2020 into 2021 will reverberate through the lives of millions. Some of those effects won’t make themselves apparent for months yet, some not for years.

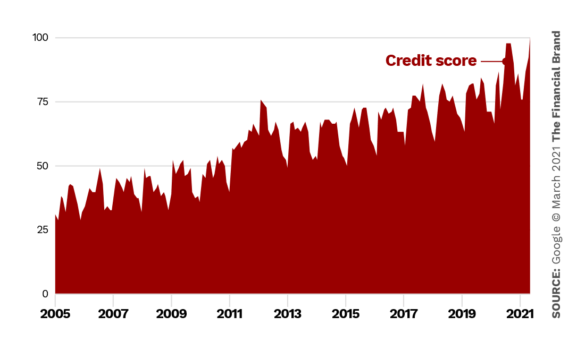

Economic Uncertainty Focuses People On Credit Scores

The massive interest in government assistance due to COVID’s impact on many aspects of the economy, especially tourism, hospitality and anything connected to an office, can be seen in the chart below. This shows the influence of multiple federal and state stimulus efforts, for example.

Younger people are among those affected most strongly by COVID’s economic damage, but many were already becoming much more conscious of their credit.

Both Millennials and Gen Z have focused on their credit scores more than earlier generations. Some of this is the lasting legacy of the Great Recession, but some of it is a reaction to the growing number of ways to obtain the data.

Not long ago obtaining a credit report or score was a project for a consumer, but now it may be as close as their favorite financial app, such as Credit Karma, which provides both for free.

( Read More: Financial Marketers Fighting Stiff Lending Headwinds in 2021 )

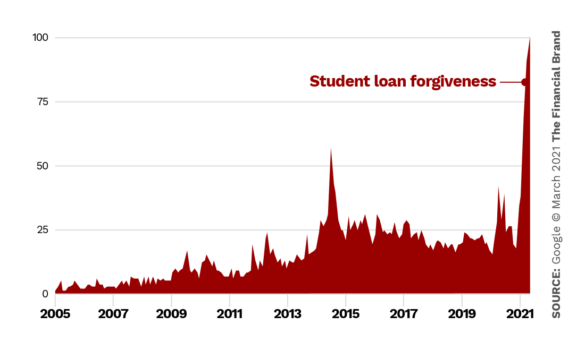

Of Student Loans And Loans On Homes

Younger consumers also face pressures their parents didn’t, notably huge student debt. No surprise, then, to see the tremendous interest in forgiveness of some portion of that debt.

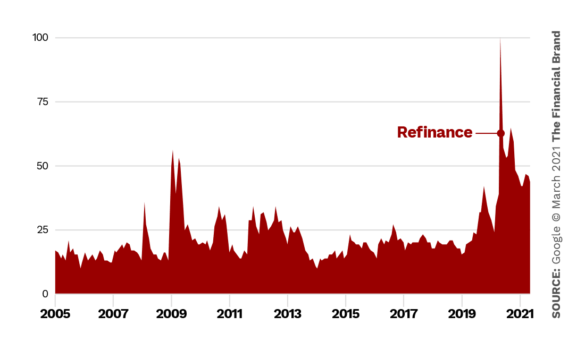

As much as COVID slammed parts of the economy and as much as it hurt many individuals, the federal effort to pour money into the economy and to keep interest rates down combined to make yet another opportunity for consumers to refinance mortgages.

The continuing interest in refinancing is a bright spot for lenders, who remain flush with cash as many people sought safety in insured deposits, and in some cases couldn’t spend money in categories such as vacations.

6. Scanning The Retail Banking Environment

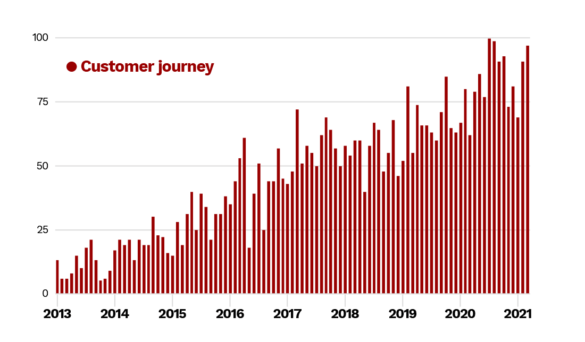

As the COVID exigency passes, there will be more emphasis on the customer journey. Already this key marketing concept has broadly been growing, as indicated by the chart below. With increasing competition in retail banking services, institutions will have to focus harder on getting consumers from the top of “the funnel” through to the ultimate “sale.”

Hazy Picture For Housing Credit

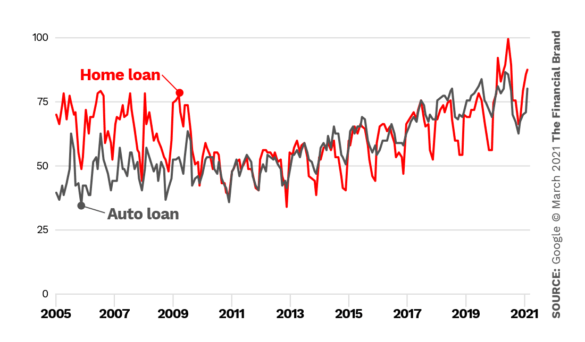

As the economy reopens, there will be more demand for housing, especially as residents of some cities continue to seek to move out to suburbs. However, with rates rising a bit, that may quash some purchases and may curtail refinancings.

In addition, while many lenders would like to make auto loans, automakers are still recovering from supply shortages of earlier in the pandemic. This is even though demand has been augmented by people preferring their own wheels to sharing space on public transit.

Spending And Saving During A Pandemic

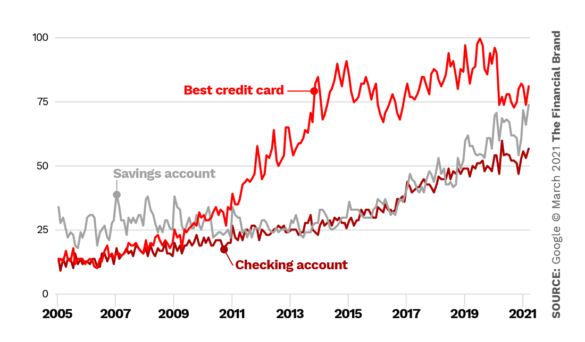

With the arrival of multiple stimulus checks and curtailment of some sources of spending, many who aren’t unemployed have been saving money. So it’s not surprising that searches for savings accounts pulled ahead of those for checking. Folks with funds they can tie up want a really good deal and that takes searching. On the other hand, the drop in searches for credit cards jibes with reports of less demand as consumers tried to hold the line on debt.

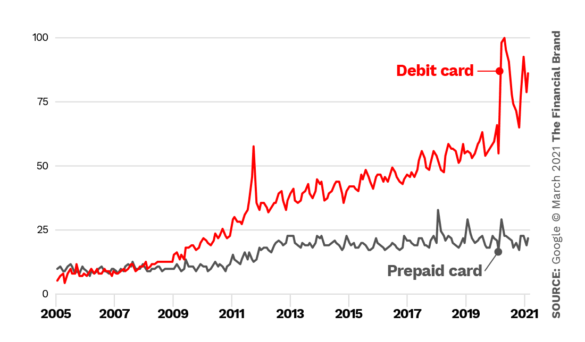

People have had to spend on necessities and extras that notch with the COVID lifestyle — more streaming services, for example, instead of going out. Hence it is not surprising to see interest in debit cards climbing.

Read More About Google and Banking:

"search" - Google News

March 29, 2021 at 12:32PM

https://ift.tt/2PCDyR0

2021 Google Search Trends in Banking, Digital, Payments & Fintech - The Financial Brand

"search" - Google News

https://ift.tt/2QWB6Sh

Bagikan Berita Ini

0 Response to "2021 Google Search Trends in Banking, Digital, Payments & Fintech - The Financial Brand"

Post a Comment